Jonathan Majors’ Ex-Girlfriend Drops Assault and Defamation Lawsuit

Some 15 percent of Americans are enrolled in Medicare Part D, which covers outpatient prescription drug costs for older adults and other qualifying individuals, providing nearly $140 billion a year in support to about 50 million people. But the program is administered by the Centers for Medicare and Medicare Services—which President-elect Donald Trump has nominated celebrity physician Mehmet Oz to lead.

It’s questionable how a man infamous for promoting questionable supplements, who has commented that there’s no right to health for people who can’t afford it, will help lead and provide government health insurance in the United States. On his show, the cardiothoracic surgeon has mounted attacks on medications that Part D covers, such as antidepressants, claiming that they do not work for most patients (the evidence is against him).

Given his history, it makes sense that Oz would be part of Trump’s “Make America Healthy Again” cohort, which does seem fairly anti-science: Robert F. Kennedy Jr.’s attacks on vaccines, for instance, also conveniently ignore that measles and polio can cause lifelong health conditions. Medicare Part D currently covers the costs of all recommended vaccines.

But what kind of damage could Oz do from his new post? Will he be able to cut medications that actually help people manage chronic health conditions—conditions that people who qualify for Medicare are more likely to have? The short answer is no. At least not on his own.

Juliette Cubanski, deputy director of health nonprofit KFF‘s program on Medicare policy, explains that the range of medications covered by Medicare Part D is specified in the Social Security Act.

“Generally speaking, Medicare Part D covers drugs and vaccines that are approved by the Food and Drug Administration,” Cubanski told Mother Jones. “The law specifically excludes some types of drugs from coverage under Part D, including drugs used for weight loss or cosmetic purposes.” So dubious supplements that Oz promoted on his show could not readily be added to the list, nor could he easily remove actual medication.

“Congress would need to change the law in order to change what drugs Medicare Part D covers,” Cubanski said. “An agency official acting under their own authority can’t do that.”

There is still the possibility that some aspects of Medicare Part D could change through a regulatory process, says University of Pennsylvania health law and policy professor Allison Hoffman, but that too is a rigorous procedure—and attacking Medicare would also be a risky political move.

“Medicare Part D was passed during a Republican administration and with Republican control in Congress, with Democratic support,” Hoffman said. “Trump knows to tread carefully in this space because Medicare is a widely popular program and the Part D program has really created a lot of financial security for people.”

But if Republicans do, as they have pledged, go after the Inflation Reduction Act, which helped fund and improve Medicare affordability, Part D isn’t necessarily in the clear. The IRA instituted a new $2,000-a-year cap on out-of-pocket spending costs for prescriptions—still a lot for many older Medicare patients, and for qualifying younger disabled people, but an extremely short-lived protection if it’s immediately overturned by the GOP.

And while Oz on his own can’t screw up Medicare Part D too badly, there’s no guarantee he’ll let it work smoothly, either. In practice, the plans are administered by private insurance companies, which can choose which pharmacies to work with and even which medications to cover. Federal health reforms like the Affordable Care Act have focused in part on making it harder for insurers to weasel out of providing care—not a likely priority for Trump’s health officials. If someone on Medicare needs to start a new medication, they could meet with a rude awakening.

“That would require them to either switch to a different drug in the class, or switch plans during the next open enrollment period,” says Julie Donohue, chair of the University of Pittsburgh’s Department of Health Policy and Management.

Such limitations in Part D—and related programs, like private-insurer-run Medicare Advantage plans—illustrate the consistent failures of privatizing Medicare, something Oz nevertheless pushed for more of during his unsuccessful 2022 Senate campaign.

With the chaos and uncertainty that’s marked Trump’s White House nominations—like former Rep. Matt Gaetz withdrawing on Thursday from consideration to be his Attorney General—Hoffman also cautions us to “wait to see if people are confirmed,” rather than immediately panicking about “our imagination of what these policies might be.”

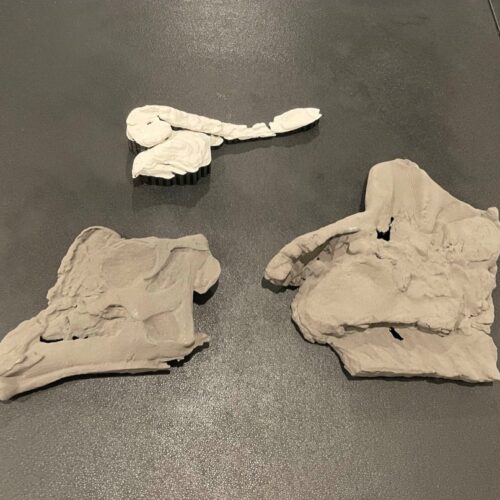

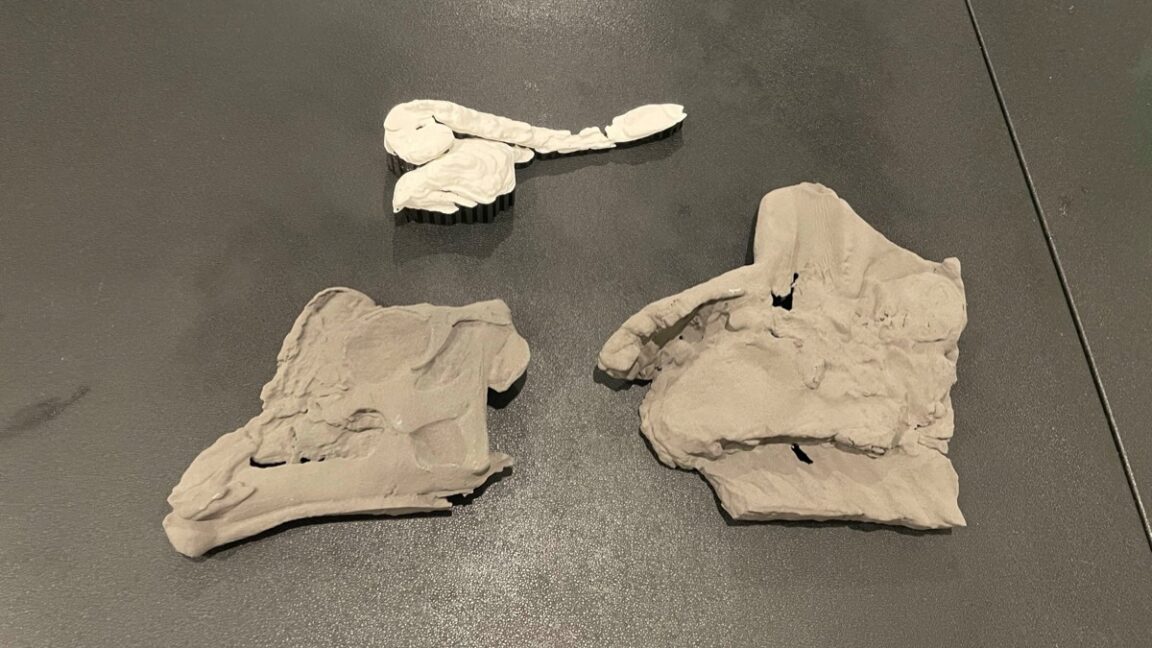

The duck-billed dinosaur Parasaurolophus is distinctive for its prominent crest, which some scientists have suggested served as a kind of resonating chamber to produce low-frequency sounds. Nobody really knows what Parasaurolophus sounded like, however. Hongjun Lin of New York University is trying to change that by constructing his own model of the dinosaur's crest and its acoustical characteristics. Lin has not yet reproduced the call of Parasaurolophus, but he talked about his progress thus far at a virtual meeting of the Acoustical Society of America.

Lin was inspired in part by the dinosaur sounds featured in the Jurassic Park film franchise, which were a combination of sounds from other animals like baby whales and crocodiles. “I’ve been fascinated by giant animals ever since I was a kid. I’d spend hours reading books, watching movies, and imagining what it would be like if dinosaurs were still around today,” he said during a press briefing. “It wasn’t until college that I realized the sounds we hear in movies and shows—while mesmerizing—are completely fabricated using sounds from modern animals. That’s when I decided to dive deeper and explore what dinosaurs might have actually sounded like.”

A skull and partial skeleton of Parasaurolophus were first discovered in 1920 along the Red Deer River in Alberta, Canada, and another partial skull was discovered the following year in New Mexico. There are now three known species of Parasaurolophus; the name means "near crested lizard." While no complete skeleton has yet been found, paleontologists have concluded that the adult dinosaur likely stood about 16 feet tall and weighed between 6,000 to 8,000 pounds. Parasaurolophus was an herbivore that could walk on all four legs while foraging for food but may have run on two legs.

© Hongjun Lin

It was clear from the outset that the Joint Resolutions of Disapproval from Sen. Bernie Sanders (I-Vt.) would not pass. The trio of bills, brought to a vote on Wednesday night, would have stopped $20 billion in weapons from being sent to Israel. Every single Republican in the Senate voted against Sanders, as expected. A majority of Democratic senators voted against the bills, too.

But there has still been movement in favor of limiting military aid: About 40 percent of the Democrats present for the vote wanted to stop billions in arms sales to Israel, despite loud opposition from the White House, Senate Majority Leader Chuck Schumer, and the American Israel Public Affairs Committee (AIPAC).

Major figures in the Democratic Party—Sen. Elizabeth Warren (D-Mass.), Sen. Tim Kaine (D-Va.), Sen. Dick Durbin (D-Ill.), Sen. Raphael Warnock (D-Ga.)—voted for at least one of the resolutions. Nineteen senators backed at least a piece of Sanders’ call to limit aid, a historically high number showing explicit, public support for upholding American law as it applies to Israel.

Polls show that the majority of Americans support suspending offensive weapons to Israel until an end comes to the country’s yearlong bombardment of Gaza—in which, experts estimate, over 100,000 people have already been killed. But that majority view—endorsed even by some explicitly pro-Israel organizations, such as J Street—has not been reflected in the US government.

In fact, hours before Sanders brought his resolutions to the Senate floor, the United States vetoed another ceasefire resolution in the United Nations. It is the fourth such resolution since Israel’s war in Gaza—which United Nations agencies, independent experts, and several world governments have declared a genocide—began. (That resolution would have demanded the release of all hostages, and implemented Biden’s own ceasefire plan.)

On the Senate floor, Sanders spoke next to a large photo of a dead, emaciated Palestinian child. “Every member of the Senate who believes in the rule of law, that our government should obey the law, should vote for these resolutions,” he said. “The Foreign Assistance Act and the Arms Export Control Act are very clear. The United States cannot provide weapons to countries that violate internationally recognized human rights or block US humanitarian aid. That is not my opinion, that is what the law says.”

In mid-September, Biden administration leaders sent a letter to Netanyahu warning him of these specific provisions of US law, and saying Israel had 30 days to improve humanitarian conditions in Gaza or face cuts to military aid. But 30 days came and went, Palestinians continued to starve, and the Biden administration refused to enforce its own deadline.

Joint Resolutions of Disapproval are not unheard of—they’ve previously been levied against Saudi Arabia and Egypt, for example—but this is the first time that this type of weapons-trade-restricting measure has been brought against Israel, which is by a far larger recipient of US weapons, having been given about $310 billion in military aid from the US since its founding.

Sanders recounted anecdotes from doctors who saw civilians shot in the head in Gaza, explained that per satellite imagery two-thirds of the buildings in Gaza are flattened entirely, and told fellow congresspeople that reporting showed almost no one in Gaza has had consistent access to electricity or clean water for nearly 14 months.

“Fundamentally, [President] Joe Biden will not uphold the law,” Matt Duss, a former Sanders aide now at the Center for International Policy, said of the White House pressure campaign to vote against Sanders. Instead, it’s “purely ideological: [Biden] just believes that Israel is entitled to absolute total wall-to-wall support, no matter how catastrophic the impact on Palestinians or Lebanese.”

“A lot of people wrongly thought that it was because of political considerations,” Duss continued. “But no, even after the election, [the administration] remains completely committed to ignoring US law and keeping the flow of weapons running, even with the knowledge that these particular weapons will not reach Israel for over a year.”

The first bill to be voted on Wednesday night concerned exploding tank shells. Cat Knarr of the US Campaign for Palestinian Rights noted that these shells are thought to have killed 6-year-old Hind Rajab as she sat alone with the bodies of her family, pleading for help. Knarr’s group staged a protest the day before the vote at the Senate. “You’re either on the side of justice and stopping the weapons, or you’re on the side of arming a genocidal state, and you will go down in history for how you vote today,” she said.

When opponents of the JRDs came to the floor, their talking points sounded like they were lifted directly from a White House memo circulated earlier that morning. As reported by Akbar Shahid Ahmed of the Huffington Post, the White House declared that those who would block weapons to Israel were aiding Hamas and prolonging the war.

Ted Budd (R-N.C.) and Lindsey Graham (R-S.C.) are among the senators who seemed to speak from that playbook. “If you love peace you have to destroy those who hate peace,” Graham said.

No one argued against Sanders’ fundamental point—that sending weapons to a nation blocking humanitarian aid is illegal. Instead, they said Israel needed to defend itself against a region in which it is the only reliable ally for the West. Senator John Neely Kennedy (R-La.) said of the Palestinian people: “They hate Americans. They want to kill us and drink our blood out of a boot.”

But the closeness of Israel and the West is showing signs of cracking.

The next day, the International Criminal Court issued arrest warrants for Israeli Prime Minister Benjamin Netanyahu and former Minister of Defense Yoav Gallant for using starvation as a weapon of war as well as “murder, persecution, and other inhumane acts.” This marked the first time the ICC has ever indicted a pro-Western official on war crimes charges—which means the United States is certain to push back. After 14 months of unabated carnage, opposition to arming Israel even within the United States is looking less fringe.

This story was reported by Floodlight, a nonprofit newsroom that investigates the powerful interests stalling climate action.

When Miguel Zablah bought his five-bedroom home in Miami’s leafy Shenandoah neighborhood in June of 2020, he said he paid $7,000 a year for homeowner’s insurance.

The house, built in 1923, sits on high ground and has survived a century of famously volatile South Florida weather. But in just four short years, Zablah said his homeowner’s insurance premium has more than doubled to $15,000 a year. Quotes for next year’s premiums are looking even worse.

“Some insurance companies are now quoting me at $20,000, $25,000 on my house, which is ridiculous,” said Zablah, who works in private equity. The premium increases are so steep that he’s considering just paying off his mortgage—and foregoing the insurance that his lender requires him to carry. “I’m very grateful that I’m in a good position,” he added.

Zablah’s premium increases are a symptom of a broader insurance crisis plaguing real estate markets across America. Experts say it’s fueled, in large part, by the disastrous effects of human-caused climate change.

Flooding is more frequent. Higher temperatures stoke stronger hurricanes. Wildfires burn more acres. And Americans have spent generations moving to sunny places that are often the most in harm’s way, including Florida, Texas, and California.

In Louisiana, some residents along coastal Highway 56 have decided to leave, in part, because they can’t get coverage.

So, the cost of insuring homes against natural disasters is spiking along with atmospheric temperatures and carbon dioxide levels.

Now, new research shows that higher insurance premiums like the one Zablah is paying significantly increase the probability of people falling behind on their mortgages—or motivate them to pay the debt off early. The outcomes spell trouble for banks, and for homeowners.

How significant is the increase in mortgage trouble? A $500 spike in annual insurance premiums was linked to a 20 percent higher mortgage delinquency rate.

That figure was extracted from findings in a recent study, which will be expanded and then undergo peer review, according to Shan Ge, an assistant professor of finance at New York University and one of the paper’s authors.

“What we found, which is the first in the literature, is that as insurance premiums go up, we have seen an increase in delinquency of mortgages,” Ge said. The research adds to a growing body of scientific literature proving that the climate crisis is also a housing crisis.

It’s a crisis with a brutal, but important side effect: Higher premiums may convince people in vulnerable areas like Miami to move out of harm’s way.

“The market is clearly adapting, and there will be winners and losers…but ultimately there should be more winners to the extent that it sends signals and people get out of the way,” said Jesse Keenan, a professor of sustainable real estate and urban planning at Tulane University who was not involved in the study.

Zablah also heads the board of the Brickell Roads condominium association in Miami, where he owns an investment property. The effects of climate change are felt there too.

Brickell Roads residents had been paying $350 a month in condo fees in 2022. But then Weston Insurance, the carrier of the association’s windstorm policy, went bust.

It was the fifth Florida insurance carrier to fold that year in the wake of Hurricane Ian, which slammed into the Southeast United States, causing an estimated $112 billion in damage. It was the most expensive storm ever in Florida and third most expensive in US history.

As the association scrambled to find a replacement policy, it confronted a stark reality: Monthly condo fees would more than triple under their new insurance policy. On October 1, 2023, it raised the condo fee at Brickell Roads to $1,000 a month. (The board has since found another insurance carrier and hopes to lower the fee to $700 a month, according to Zablah.)

“In some Florida counties, homeowners are paying over 5 percent of their income just on their policies.”

Climate change has blown a hole through insurance markets across the United States. In Louisiana, some residents along coastal Highway 56 have decided to leave, in part, because they can’t find companies willing to insure their homes.

In California, that state’s Department of Insurance has barred carriers from not renewing policies in certain fire-prone zip codes, essentially forcing the companies to insure properties there. And in Florida, a volatile mix of fraud, litigation, floods, and hurricanes has left homeowners like those in Brickell Roads scrambling for coverage.

One major reason for the spike in insurance prices is a rise in the cost of the insurance coverage that insurance companies purchase for themselves, known as reinsurance. Globally, reinsurers raised prices for property insurers by 37 percent in 2023. (Prices stabilized somewhat in 2024.)

Insurers have passed those costs on to customers, said industry analyst Cathy Seifert during a Bloomberg TV appearance on November 4. “The insurance industry will leverage climate change into pricing strength,” she said.

Analysts and scholars who study the nexus between climate change and housing had long theorized that higher insurance rates would negatively affect property markets.

An August 2024 report by the Congressional Budget Office noted that in 2023, 30 percent of losses from natural disasters went uninsured. Those losses further constrict an already tight supply of housing. Researchers have also found that higher insurance rates affect the availability of affordable housing. It turns out, housing markets might be more sensitive to premium spikes than many thought.

Using a dataset that links insurance policies with mortgages for 6.7 million borrowers, Ge and two other researchers established that spikes in insurance premiums led a significant number of borrowers to either pay off their mortgages early or fall behind. Obviously, many homeowners can’t afford to accelerate their mortgage payoff.

The researchers found that the effect of premium increases on mortgage delinquency is twice as large for borrowers with a high loan-to-value ratio, meaning they owe a lot of money on their homes compared to the home’s value.

“This is how many people across the country are beginning to directly experience how climate change is changing our world and the cost it’s going to have,” said Moira Birss, a research fellow at the Climate and Community Institute. “In some Florida counties, homeowners are paying over 5 percent of their income just on their (insurance) policies.”

Conversely, the NYU study found that people who took out jumbo mortgages—large loans for expensive houses that regular loans won’t cover—were three times less likely to end up falling behind on payments. Because more than two-thirds of mortgages are backed by the federal government, it’s taxpayers who could be left holding the bag from rising climate-caused delinquencies.

“I think it’s the tip of the iceberg.” said Wayne Pathman, a Miami-based land use attorney who has spent years working on resilience issues in the region. “I think it is going to get a lot worse.”

Pathman says he is seeing similar premium increases in the commercial property insurance market—and is also witnessing owners of office buildings consider choices similar to that of Zablah, the homeowner.

Pathman recounted how one of his clients, a hotel operator, handled a looming increase in his insurance premiums. He paid off the mortgage on the building and decided to forego the $1-million-a-year premiums for windstorms.

So next time a hurricane blows in, he’ll be on his own.

This story was reported by Floodlight, a nonprofit newsroom that investigates the powerful interests stalling climate action.

When Miguel Zablah bought his five-bedroom home in Miami’s leafy Shenandoah neighborhood in June of 2020, he said he paid $7,000 a year for homeowner’s insurance.

The house, built in 1923, sits on high ground and has survived a century of famously volatile South Florida weather. But in just four short years, Zablah said his homeowner’s insurance premium has more than doubled to $15,000 a year. Quotes for next year’s premiums are looking even worse.

“Some insurance companies are now quoting me at $20,000, $25,000 on my house, which is ridiculous,” said Zablah, who works in private equity. The premium increases are so steep that he’s considering just paying off his mortgage—and foregoing the insurance that his lender requires him to carry. “I’m very grateful that I’m in a good position,” he added.

Zablah’s premium increases are a symptom of a broader insurance crisis plaguing real estate markets across America. Experts say it’s fueled, in large part, by the disastrous effects of human-caused climate change.

Flooding is more frequent. Higher temperatures stoke stronger hurricanes. Wildfires burn more acres. And Americans have spent generations moving to sunny places that are often the most in harm’s way, including Florida, Texas, and California.

In Louisiana, some residents along coastal Highway 56 have decided to leave, in part, because they can’t get coverage.

So, the cost of insuring homes against natural disasters is spiking along with atmospheric temperatures and carbon dioxide levels.

Now, new research shows that higher insurance premiums like the one Zablah is paying significantly increase the probability of people falling behind on their mortgages—or motivate them to pay the debt off early. The outcomes spell trouble for banks, and for homeowners.

How significant is the increase in mortgage trouble? A $500 spike in annual insurance premiums was linked to a 20 percent higher mortgage delinquency rate.

That figure was extracted from findings in a recent study, which will be expanded and then undergo peer review, according to Shan Ge, an assistant professor of finance at New York University and one of the paper’s authors.

“What we found, which is the first in the literature, is that as insurance premiums go up, we have seen an increase in delinquency of mortgages,” Ge said. The research adds to a growing body of scientific literature proving that the climate crisis is also a housing crisis.

It’s a crisis with a brutal, but important side effect: Higher premiums may convince people in vulnerable areas like Miami to move out of harm’s way.

“The market is clearly adapting, and there will be winners and losers…but ultimately there should be more winners to the extent that it sends signals and people get out of the way,” said Jesse Keenan, a professor of sustainable real estate and urban planning at Tulane University who was not involved in the study.

Zablah also heads the board of the Brickell Roads condominium association in Miami, where he owns an investment property. The effects of climate change are felt there too.

Brickell Roads residents had been paying $350 a month in condo fees in 2022. But then Weston Insurance, the carrier of the association’s windstorm policy, went bust.

It was the fifth Florida insurance carrier to fold that year in the wake of Hurricane Ian, which slammed into the Southeast United States, causing an estimated $112 billion in damage. It was the most expensive storm ever in Florida and third most expensive in US history.

As the association scrambled to find a replacement policy, it confronted a stark reality: Monthly condo fees would more than triple under their new insurance policy. On October 1, 2023, it raised the condo fee at Brickell Roads to $1,000 a month. (The board has since found another insurance carrier and hopes to lower the fee to $700 a month, according to Zablah.)

“In some Florida counties, homeowners are paying over 5 percent of their income just on their policies.”

Climate change has blown a hole through insurance markets across the United States. In Louisiana, some residents along coastal Highway 56 have decided to leave, in part, because they can’t find companies willing to insure their homes.

In California, that state’s Department of Insurance has barred carriers from not renewing policies in certain fire-prone zip codes, essentially forcing the companies to insure properties there. And in Florida, a volatile mix of fraud, litigation, floods, and hurricanes has left homeowners like those in Brickell Roads scrambling for coverage.

One major reason for the spike in insurance prices is a rise in the cost of the insurance coverage that insurance companies purchase for themselves, known as reinsurance. Globally, reinsurers raised prices for property insurers by 37 percent in 2023. (Prices stabilized somewhat in 2024.)

Insurers have passed those costs on to customers, said industry analyst Cathy Seifert during a Bloomberg TV appearance on November 4. “The insurance industry will leverage climate change into pricing strength,” she said.

Analysts and scholars who study the nexus between climate change and housing had long theorized that higher insurance rates would negatively affect property markets.

An August 2024 report by the Congressional Budget Office noted that in 2023, 30 percent of losses from natural disasters went uninsured. Those losses further constrict an already tight supply of housing. Researchers have also found that higher insurance rates affect the availability of affordable housing. It turns out, housing markets might be more sensitive to premium spikes than many thought.

Using a dataset that links insurance policies with mortgages for 6.7 million borrowers, Ge and two other researchers established that spikes in insurance premiums led a significant number of borrowers to either pay off their mortgages early or fall behind. Obviously, many homeowners can’t afford to accelerate their mortgage payoff.

The researchers found that the effect of premium increases on mortgage delinquency is twice as large for borrowers with a high loan-to-value ratio, meaning they owe a lot of money on their homes compared to the home’s value.

“This is how many people across the country are beginning to directly experience how climate change is changing our world and the cost it’s going to have,” said Moira Birss, a research fellow at the Climate and Community Institute. “In some Florida counties, homeowners are paying over 5 percent of their income just on their (insurance) policies.”

Conversely, the NYU study found that people who took out jumbo mortgages—large loans for expensive houses that regular loans won’t cover—were three times less likely to end up falling behind on payments. Because more than two-thirds of mortgages are backed by the federal government, it’s taxpayers who could be left holding the bag from rising climate-caused delinquencies.

“I think it’s the tip of the iceberg.” said Wayne Pathman, a Miami-based land use attorney who has spent years working on resilience issues in the region. “I think it is going to get a lot worse.”

Pathman says he is seeing similar premium increases in the commercial property insurance market—and is also witnessing owners of office buildings consider choices similar to that of Zablah, the homeowner.

Pathman recounted how one of his clients, a hotel operator, handled a looming increase in his insurance premiums. He paid off the mortgage on the building and decided to forego the $1-million-a-year premiums for windstorms.

So next time a hurricane blows in, he’ll be on his own.

Americans of a certain age tend to throw around the term “Orwellian” willy-nilly. But the expression really suits in describing the behavior of our felonious, twice-impeached president-elect.

In George Orwell’s classic novel 1984, a dictatorship represented by the all-powerful “Big Brother” dictates the reality its citizens must adhere to, however topsy-turvy. Official slogans include “ignorance is strength,” “freedom is slavery,” and “war is peace.”

In this context, another slogan comes to mind: “Drain the swamp.”

Trump didn’t invent this populist expression, but he made it a centerpiece of his first campaign—a vow to rid DC of the toxic influence of special interest money, lobbyists, etc. Of course, politicians of both parties have long railed, often without much credibility, against special interests in Washington, and the US Supreme Court’s trashing of campaign finance safeguards has indeed created a cesspool of oligarchic influence in DC that crosses party lines.

It’s not the slogan itself that’s Orwellian. The Orwellian part is Trump’s evocation of the Swamp as he appoints foxes to guard the federal henhouse yet again. It’s a trolling of the libs, but a trolling with potentially dire consequences—and a signal that our government is for sale, more openly now than ever.

Exhibit A: Trump’s selection of Chris Wright, the CEO of a Denver fracking services company called Liberty Energy, for the position of energy secretary. Wright has no government experience and certainly no experience related to the nuclear weapons whose oversight is a critical part of DOE’s role.

Meanwhile, as typical of Trump’s cabinet picks to date, Wright’s other qualifications for the job are—to use Orwellian “Newspeak”—doubleplusungood.

It has escaped nobody’s notice that Trump’s top consideration in doling out key positions is loyalty to the boss. For attorney general, he chose Matt Gaetz, an inexperienced lawyer (but fierce loyalist) who has been accused of sexual impropriety—no charges were ever filed—and is notorious for allegedly foisting upon House colleagues videos of women he’s bedded. For his director of national intelligence, Trump picked Tulsi Gabbard, a former congresswoman my colleague Dan Friedman describes as a “uniquely bad choice.” Namely, she lacks intelligence experience and is so in sync with Vladimir Putin’s propaganda machine that her nomination was even celebrated on Russian television. To oversee White House communications, he picked a bomb-thrower who cut his teeth at UFC. For Health, he chose Robert Kennedy Jr., a man with no academic expertise in the areas he would oversee, and whose views and priorities are far from the mainstream, as my colleague David Corn has reported. (In this administration, apparently, ignorance is indeed strength.)

Wright, too, is a loyalist, but this pick feels distinctly transactional—Swamplike. Trump, after all, met multiple times during his campaign with top fossil-fuel CEOs, promising that, if they gave him money and helped him get elected, they would be richly rewarded. Wright, who denies the climate crisis and completely dismisses the US clean energy transition—which is weird, because it is well under way, despite the fossil fuel industry’s attempts to thwart it—is the industry’s reward. As was Trump’s choice for Interior, North Dakota Gov. Doug Burgham, who is apparently champing at the bit to expand drilling on federal land.

The New York Times reports that Wright’s wife, Liz, co-hosted a Trump fund-raiser in Montana, and that the couple donated a total of $350,000 to a Trump campaign committee. Most notably, Wright was the preferred choice of oil billionaire Harold Hamm, a major Trump donor and co-host of gatherings where candidate Trump wooed oil executives with what sounded suspiciously like a pay-to-play pitch.

Hamm has been playing the political money game for ages. As former Mother Jones reporter Josh Harkinson wrote in an early profile of the oilman, Hamm began supporting political causes in earnest starting in 2007, founding a group called the Domestic Energy Producers Alliance (slogan: “Good things flow from American oil”) and giving millions of dollars to candidates and right-wing causes supported by the billionaire industrialists Charles and David Koch—including nearly $1 million to support Mitt Romney’s unsuccessful 2012 bid for the White House.

In his rush to exploit North Dakota’s Bakken Shale, Harkinson wrote in 2012, Hamm’s company, Continental Resources, “has ridden roughshod over environmental laws….

Documents acquired by ProPublica show that it has spilled at least 200,000 gallons of oil in North Dakota since 2009, far more than any other company. That year, in one of its few formal citations against oil companies, the state’s health department fined Continental $428,500 for poisoning two creeks with thousands of gallons of brine and crude, but later reduced the amount to $35,000. Around the same time, during a thaw, four Continental waste pits overflowed, spilling a toxic soup onto the surrounding land. The Industrial Commission said it would fine the company $125,000, but it ultimately reduced the sum to less than $14,000, since “the wet conditions created circumstances that were unforeseen by Continental.”

Hamm stepped up for Trump in 2016, securing a VIP seat at the 2017 inauguration and exerting his influence during Trump’s first term. From the Washington Post:

In early 2020, he lobbied Trump to help persuade Saudi Arabia and Russia to end a price war that had driven down the price of oil below $0 a barrel, causing Hamm to lose $3 billion in just a few days.

The effort appeared to pay off. In April 2020, under pressure from Trump, members of OPEC, Russia and other oil-producing nations agreed to the largest production cuts ever negotiated—nearly 10 million barrels a day—as oil demand collapsed during the pandemic.

This time around, Hamm, now Continental’s executive chairman, and his fellow oil and gas executives, would love to see some of those pesky environmental regulations go bye-bye, including the fines imposed under President Joe Biden’s Inflation Reduction Act on drillers who spew waste methane—a particularly potent greenhouse gas and primary component of so-called natural gas—into the atmosphere.

The purpose of regulating the fossil fuel industry is to ensure Americans clean air and water and at least some hope of escaping the worst ravages of a warming planet. Killing such regulations, and preventing new ones that cost his donors money, is a big part of what this second Trump administration—not to mention the US Supreme Court, with its decisions crippling the automony of federal agencies—is poised to deliver.

Call it Swamp 2.0.