Newport Was Used to Billionaires. Then Stephen Schwarzman Came to Town.

The first thing the neighbors on Newport’s Bellevue Avenue complained about was the helipad.

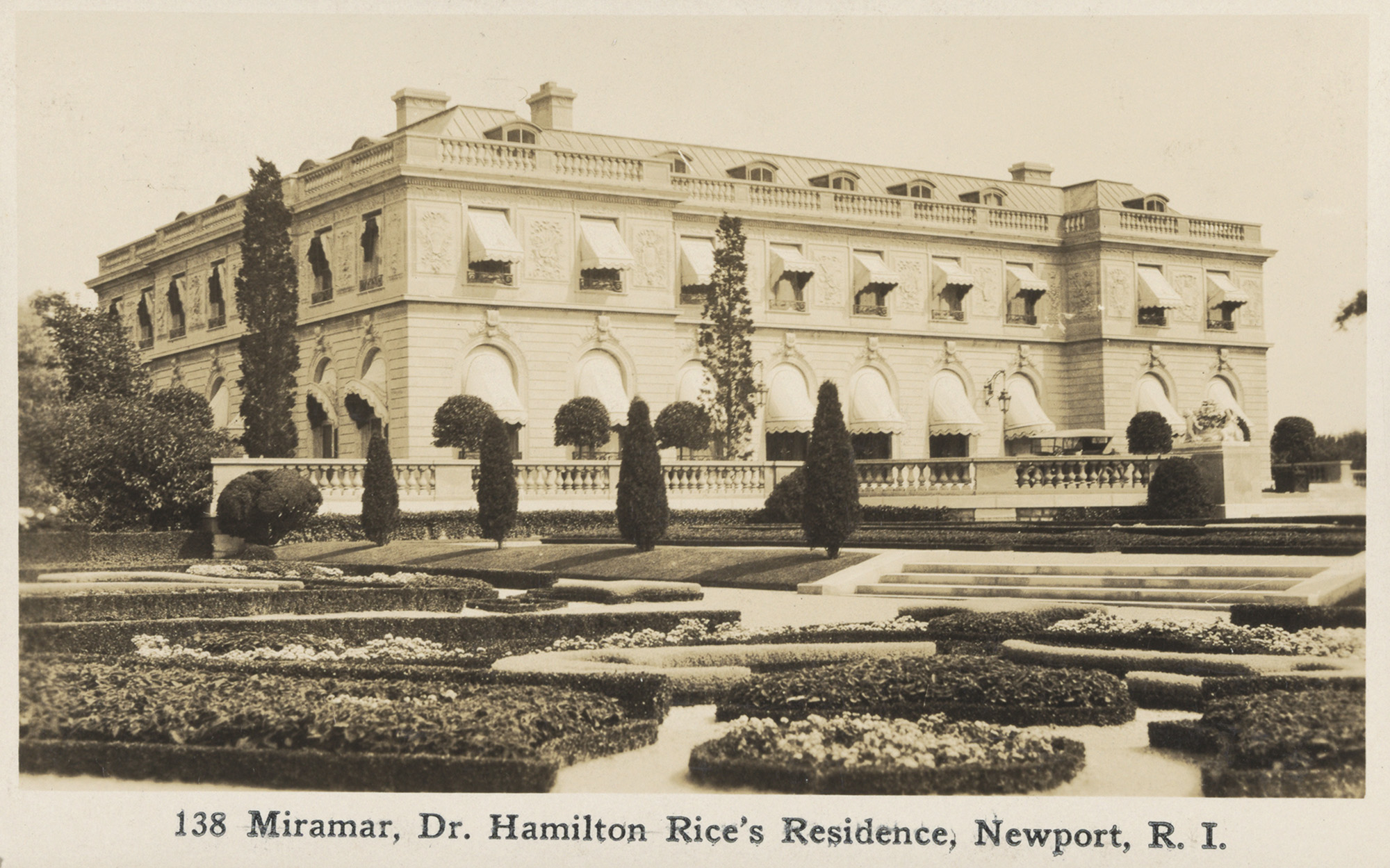

The 2-mile stretch of Rhode Island coast has long been a playground for America’s billionaires, lined with lavish, historic mansions. But for as long as most could remember, old money had meant an untouchable kind of peace, not the thunderous noise of a chopper. Now the New Yorkers who’d bought 646 Bellevue—a Gilded Age estate known as Miramar—had turned a patch of grass on their 8 acres of oceanfront land into their very own LaGuardia, and folks weren’t happy about it.

“Having Sikorskys land in the neighborhood does seem contextually off, noisy, and potentially unsafe,” one neighbor emailed to another, referring to a brand of helicopter. They didn’t even ask Newport’s zoning board, she’d heard. Her concern, she emphasized, was “the character, livability, and safety of the neighborhood.” This wasn’t about begrudging the mansion’s new owners, Wall Street titan Stephen Schwarzman and his wife, Christine; by all accounts, they were “very nice people.”

Schwarzman, the 77-year-old CEO of private equity giant Blackstone, had purchased Miramar the year before, in the fall of 2021. The mansion, which boasts 44,000 square feet of living space, including 22 bedrooms, 14 bathrooms, and a seven-bed, seven-bath guesthouse, was completed in 1915 for a streetcar magnate who later died on the Titanic. Within months of buying Miramar, Schwarzman also acquired the residence next door, Ocean View, which has 15 bedrooms, 12 bathrooms, and a six-car garage. Together, they cost $43 million—making Schwarzman’s megaproperty among Newport’s most expensive home purchases ever.

A slice of Schwarzman’s fortune has gone to indulging his famously extravagant tastes. Another chunk has gone to the GOP and Donald Trump.

Schwarzman’s pandemic splurge came just as his firm decided to double down on scooping up rental housing. During the housing crash of the Great Recession, Blackstone had snapped up underwater homes for cheap and eventually made a fortune. The Covid collapse offered Blackstone another bite at the apple. In 2021 and 2022, it bought up 200,000 new units of rental housing at bargain-basement interest rates, adding to a portfolio of more than 150,000 rentals and making Blackstone the nation’s biggest corporate landlord. The firm’s real estate arm is core to its business, worth about $337 billion—about a third of its total investments—and its rental portfolio has seen a healthy return of about $11 billion over the last decade, hiking rent on some of its properties by nearly 80 percent.

A slice of that fortune has gone to indulging Schwarzman’s famously extravagant tastes, such as the $5 million bash he threw in 20o7 to celebrate his 60th birthday, or the roughly $200 million worth of vacation homes he’s purchased in England; Jamaica; Palm Beach, Florida; St. Tropez, France; and the Hamptons in New York. Another chunk has gone to the GOP and Donald Trump. A longtime Republican megadonor, Schwarzman said in 2022 that he’d no longer support the former president, having called the January 6 insurrection “an affront to democratic values.” But when the abstraction of “values” bumped up against the reality of money, money won. Schwarzman is a major donor again this election cycle, giving more than $20 million to Republican candidates—with the GOP’s tax cuts for the superwealthy set to expire less than a year into the next president’s term.

It’s not only the roar of helicopter blades irritating Schwarzman’s neighbors: His massive renovation at Miramar has incensed local residents, not for its opulence—this town is used to the wild construction demands of wealthy out-of-towners—but for its Marie Antoinette level of disregard for the community. And as the drama of his Petit Versailles has irked Schwarzman’s neighbors, it has also offered a window into what happens when he throws his might and fortune behind a goal—be it a Rhode Island palace or a potential president.

Not as scene-y as the Hamptons or as flashy as Palm Beach, Newport is only a three-hour drive from Wall Street and, for a relative bargain, offers extravagant manors situated along hundreds of miles of idyllic coastline. But the city of 24,000 is squeezed into the corner of an island on Narragansett Bay, which means that less-affluent residents living in the nearby North End, including military families on its naval base, couldn’t ignore the rich and powerful if they tried.

“When I go to a barre class, I’ll just see [US Sen. and multimillionaire] Sheldon Whitehouse outside of Le Bec Sucré, you know, standing in line to get his croissant,” says North End resident and Newport Public Schools activist Amy Machado, drawing out the pronunciation: kwaa–SOHN.

Nowhere is the gap between rich and regular more acute than Bellevue Avenue, where the homes that surround Schwarzman’s Miramar are lousy with opulence and the sort of melodrama that only the moneyed set have time for. There’s a replica of a 17th-century chateau built for King Louis XIV and his mistress, along with several of the Vanderbilts’ former summer homes—one made of marble and another a 70-room Italian Renaissance-style palazzo. There is also the mansion once home to an alleged murderer, a billionaire tobacco heiress who almost definitely killed her interior designer. On the southern end of the street, old money gives way to nouveau riche: Oracle’s Larry Ellison, currently the world’s second-richest man, has spent more than $100 million renovating his estate and landscaping the grounds with a maze of shrubs and boulders so ugly it has become something of a local pastime to ridicule it. Nearby is a villa owned by another Wall Street CEO that was once home to a Nazi collaborator’s son who was convicted and later acquitted of twice trying to murder his heiress wife.

Schwarzman is spending at least $7 million to add, among other things, a pool, a tennis court, bronze windows, pergola and lattice pavilions, a fountain, and a guard house.

It’s all gorgeous and gossipy until you start thinking about the source of all this money, a nagging feeling almost as old as the town itself: “There is something in the air that has nothing to do with pleasure and nothing to do with graceful tradition,” Joan Didion wrote of Newport in 1967. “[A] sense not of how prettily money can be spent but of how harshly money is made.”

Schwarzman is, indeed, using harsh money to make pretty things. Specifically, he’s spending at least $7 million to add a pool, a tennis court, two bathrooms, a full guesthouse renovation, bronze windows, pergola and lattice pavilions, a fountain, a guard house, a skylight, a generator, a state-of-the-art geothermal HVAC system, and a modern iteration of the estate’s early 20th-century gardens.

And that would all be fine—normal, even, for the area—if it weren’t for what happened on nearby Yznaga Avenue. A short, leafy dead-end road right off Bellevue, Yznaga leads to Miramar’s service entrance. Schwarzman’s contractors soon lined the street seven days a week with dozens of trucks, from early dawn well into the night—sometimes past midnight.

The single homeowner on Yznaga, Mark Brice, often found himself unable to get out of his driveway. He asked the city for a parking ban that would stop Schwarzman’s crews, and anyone else, from parking on the street and blocking his route. (Brice did not respond to requests for comment.)

Banning parking on a single street may not sound like a big deal. But Yznaga Avenue, named after a 19th-century slave-owning sugar merchant, is one of the only streets where people from less-affluent parts of town can park for free and walk to some of Newport’s most beloved green spaces: Rovensky Park, the Cliff Walk, and “Rejects Beach”—a public beach next to Newport’s most exclusive beach club, Bailey’s.

The street has been a local battleground for years, with some wealthy neighbors insisting it is private, even going so far as to put up “No Parking” signs. (Newport’s zoning office confirms that Yznaga has always been city owned.) With Schwarzman’s arrival, the street remained public in theory, but in practice, it had become his construction staging area, with little room for Newporters to park and regular blockades for the one unlucky neighbor.

“The level of construction that is happening there is hidden away from view but quite stunning when you see it.”

When Brice’s parking proposal went before the city council last spring, residents were furious that the city was considering a parking ban on Yznaga to solve a problem created by a billionaire. They flooded council members with angry letters: “It is both elitist and selfish to move forward,” one resident wrote. “A thinly disguised effort to enhance the exclusivity of that neighborhood,” opined another. “This has been a benefit forever for residents in an area that is mostly conceded to the uber-rich,” wrote a third person. “There’s a reason the beach there is called Rejects.”

The council held two hearings on the bill. From their dais at City Hall, they marveled at how sprawling the construction was. One council member said he analyzed Google satellite photos of Miramar and the project’s spillover onto Yznaga, and even drove down to the area himself. How bad could it really be? “It’s bad,” he concluded. “It is actually unprecedented. I haven’t seen anything that bad in this city. The level of construction that is happening there is hidden away from view but quite stunning when you see it.”

The council member whose district includes Bellevue agreed. “There is an unfathomable amount of construction,” he told his colleagues. His constituents had taken to sending him videos of the construction vehicles “entering up and down and up and down” Yznaga as early as 4:30 a.m.

Every local who testified spoke against the ban, except Brice, the homeowner on Yznaga. For council members, the central question became how to balance public beach access against the needs of a man who couldn’t exit the driveway of his $5 million house. But no one seemed to consider, out loud at least, addressing the root of the problem: the man with the $43 million property who messed up the street in the first place.

Eventually, the council voted for a full ban, contrary to the advice of the fire chief and traffic department, both of which recommended prohibiting parking on just one side of the street. So, by inconveniencing his neighbor, Schwarzman got a private driveway where his workers never have to compete for a spot. When I visited in August, I saw six trucks parked bumper to bumper, in violation of the ban. No one from the city seemed to mind.

The fight over Yznaga Avenue, it turned out, was just the tip of the iceberg. About six months after moving in, Schwarzman inquired with the Rhode Island Airport Corp. about registering his Miramar helipad with the Federal Aviation Administration. But Schwarzman abandoned the application, according to the RIAC, and never filed it. That didn’t stop him from having a helicopter land on the property regularly—sometimes multiple times per week. (A Schwarzman spokesperson told Mother Jones that the RIAC’s chief aeronautics inspector visited the site and approved it and that registration is now pending with the FAA. The RIAC told Mother Jones that after the inspector’s visit, no application was ever filed or approved. The FAA also told Mother Jones there is no pending application.)

One neighbor in Schwarzman’s flight path wondered why he sometimes opted to fly low right over the neighborhood instead of the water, which would be less intrusive and easy to do, given that Miramar’s landing pad is next to the ocean. “I thought, ‘This is really annoying,’” the neighbor said. “And why is he flying looking down on everybody? Of course, you couldn’t do that to him.” (Schwarzman’s spokesperson denied that the helicopter’s flight path went over the neighborhood.)

Then, in January 2022, Schwarzman’s team reached out to the city of Newport for permission to dig up a chunk of Bellevue Avenue to install a fiber-optic cable. Internet in the neighborhood is notoriously slow, and according to emails obtained from the city, it appeared they were planning on installing a private line just Schwarzman’s estate could use. Only after a city official intervened did the team notify neighbors of the upcoming construction and install a public line instead.

When a sinkhole suddenly appeared in the Cliff Walk this past April in front of Miramar’s fence, Newporters were pretty sure they knew who had caused it.

In August 2023, a Bellevue resident called the city manager to complain about the relentless construction and noise that never let up, with work and deliveries going on 24/7. The office contacted Newport zoning to ask when the construction was permitted and got a curt email in response—it was far from the first time it had fielded complaints about Miramar. “Yes the hours are 7am-9pm I will call her the owners of 646 seem not to care about anyone but there [sic] construction project,” the official wrote.

And there was more to aggravate neighbors, including drilling for geothermal wells. Workers also dug up the slope that stretches from the mansion to the iconic Cliff Walk, leading piles of soil to tumble onto the pathway.

When a sinkhole suddenly appeared in the Cliff Walk this past April in front of Miramar’s fence, Newporters were pretty sure they knew who had caused it. The scenic bluff overlooking Easton Bay, beloved by locals and tourists, is one of the only places in the world where you can go for a hike surrounded by stunning shoreline views on one side and eye-candy mansions on the other. The city eventually closed a quarter-mile of the walk for repairs—they’d found cracks in a portion of the walk behind Miramar and deterioration in the seawall footers that protect from erosion. The sinkhole’s cause was never confirmed, but a few months later, Schwarzman paid for the entire repair. (Schwarzman’s spokesperson called the implication that construction at Miramar had caused the sinkhole “unfounded,” citing “preexisting natural erosion issues.”)

Maybe it was a tacit apology. Or maybe it was a way for Schwarzman to make nice with his neighbors and Newport’s high society, whom he’d been courting with large donations to local charities, like the $20,000 he gave to a soiree benefiting homeless animals run by a local animal league and the approximately $100,000 he gave to Newport’s powerful preservation society.

In a town where famous titans—the Vanderbilts, the Astors, the Dukes—live on forever through palaces constructed in their image, it seems as though Schwarzman is vying to be the next immortal name. In August, he unveiled plans to turn Miramar into a public museum upon his death, saying it would be owned by a foundation and maintained with a special endowment.

Not mentioned in the statement is how the move would benefit Schwarzman himself: Without remotely changing his lifestyle, it will help him uphold the philanthropic promise he made in 2020 by joining the Giving Pledge, a club of billionaires who promise to donate at least half of their wealth to charity. The pledge isn’t binding, and it allows any giving to happen after death. Even better: Turning over the home to a foundation could lower future taxes, as would the museum designation—a common tactic used by the ultrawealthy.

A month before the 2016 election, a leaked Access Hollywood video showed Donald Trump bragging about grabbing women “by the pussy.” As the presidential candidate’s lurid remarks ricocheted across the airwaves, Trump’s running mate, Mike Pence, was en route to Miramar, where he was scheduled to headline a campaign fundraiser. (The home was then owned by a different Wall Street tycoon.)

Local GOP leaders issued statements condemning Trump’s words, then walked through Miramar’s stately gates and joined guests to donate more than $500,000. One Republican state representative explained the decision to proceed with the fundraiser despite the national uproar: “If you want to see this revolution happen, you have to get past the man and go with the ideas he represents.”

Schwarzman has done exactly that: Grit his teeth and support the guy he thinks will help his business.

In late 2022, Schwarzman vowed to get behind someone else in the GOP primary. But after more than a dozen candidates fell short, he returned to supporting Trump.

Schwarzman didn’t back Trump initially, but shortly after the 2016 election, he donated $250,000 to Trump’s inaugural committee and later agreed to work with the new president as an economic adviser. That connection opened some lucrative doors: On a trip to meet with Saudi officials with Trump in 2017, Schwarzman’s firm announced a $20 billion commitment from the kingdom for a new investment fund. He also advised Trump on China policy, encouraging the president to soften his anti-China rhetoric, which would benefit Blackstone’s extensive holdings in the country. On the campaign trail, Trump had promised to end “carried interest,” a decades-old tax break for private equity executives. But with Schwarzman on the team, Trump’s campaign promise never materialized. (Last year, Schwarzman earned about $79.5 million in carried interest.)

In late 2022, nearly two years after Trump’s supporters stormed the Capitol and after Trump-backed candidates in several states lost in the midterms, Schwarzman finally decided he wouldn’t back Trump anymore. This wasn’t the revolution he’d signed up for. He called for “a new generation of leaders” and vowed to get behind someone else in the Republican primary.

But after more than a dozen GOP primary candidates fell short, he came back into the fold. In May, with Trump’s Manhattan felony trial in full swing, Schwarzman announced that he would support his bid to defeat Joe Biden.

In August, three weeks after Kamala Harris stepped in as the Democratic nominee, rumors swirled that Schwarzman was set to host a Trump fundraiser at Miramar.

A spokesperson for the billionaire denied there was ever such a plan. But on a warm summer Thursday, Schwarzman did throw a bash at Miramar for about 200 people—the same afternoon that Harris’ running mate, Tim Walz, hosted a fundraiser a few blocks down Bellevue.

Schwarzman’s event featured greeters dressed in 18th-century garb and a carnival setup. Bright structures carved to look like castle spires dotted the grounds and guests wandered among them, prohibited from walking through most of the actual palace, which, by now, Schwarzman’s decorators had adorned with a bounty of impressionist paintings and antique French furniture, including a desk that once stood at Versailles. Men in straw boat hats and suspenders ferried attendees to and from nearby parking in golf carts.

Walz, meanwhile, went to Ochre Court, a mansion owned by a local Catholic university, Salve Regina. His event had little of Miramar’s pomp: no costumed greeters, no pinstriped chauffeurs, no carnival set. Walz spoke for 17 minutes in the three-story atrium, then sped off to his next event in the Hamptons.

By fundraising metrics, the Walz event was a success, raising $650,000. Politically, it stirred up a minor controversy. Nearly half of Rhode Islanders are Catholic, and many, including the state’s powerful diocese, bristled at a Catholic venue hosting a campaign that vocally supports abortion rights.

As it turned out, the Walz event organizers had sought out a different space, Belcourt—the third-largest Bellevue mansion. But it wasn’t available. Not because there was an event happening at the 60-room chateau, but because Schwarzman had rented it. He needed a place to store construction equipment during his yard party—and given the dearth of public parking, he would need a spillover lot.