‘Queen SongShares’ Offers Fans and Investors a Percentage of Royalties From Several of the Group’s Songs

On May 7, 2011, Georgia resident Tonya Brand noticed a pain on the inside of her right thigh. As the pain grew worse in the 4- to 5-inch area of her leg, she headed to a hospital. There, doctors suspected she had a blood clot. But an ultrasound the next day failed to find one. Instead, it revealed a mysterious toothpick-sized object lodged in Brand's leg.

Over the next few weeks, the painful area became a bulge, and on June 17, Brand put pressure on it. Unexpectedly, the protrusion popped, and a 1.5-inch metal wire came poking out of her leg, piercing her skin.

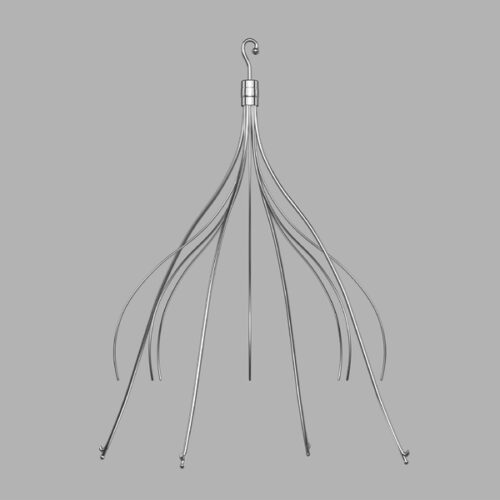

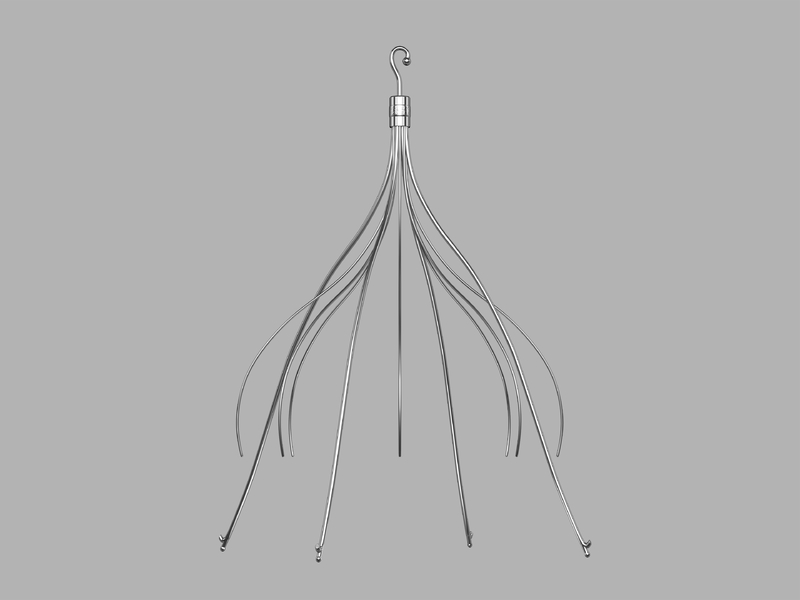

The piece of metal was later determined to be part of a metal filter she had implanted in a vein in her abdomen more than two years earlier, in March 2009, according to a lawsuit Brand filed. The filter was initially placed in her inferior vena cava (IVC), the body's largest vein tasked with bringing deoxygenated blood from the lower body back up to the heart. The filter is intended to catch blood clots, preventing them from getting into the lungs, where they could cause a life-threatening pulmonary embolism. Brand got the IVC filter ahead of a spinal surgery she had in 2009, which could boost her risk of clots.

© Cook Medical

This story was reported by Floodlight, a nonprofit newsroom that investigates the powerful interests stalling climate action.

When Miguel Zablah bought his five-bedroom home in Miami’s leafy Shenandoah neighborhood in June of 2020, he said he paid $7,000 a year for homeowner’s insurance.

The house, built in 1923, sits on high ground and has survived a century of famously volatile South Florida weather. But in just four short years, Zablah said his homeowner’s insurance premium has more than doubled to $15,000 a year. Quotes for next year’s premiums are looking even worse.

“Some insurance companies are now quoting me at $20,000, $25,000 on my house, which is ridiculous,” said Zablah, who works in private equity. The premium increases are so steep that he’s considering just paying off his mortgage—and foregoing the insurance that his lender requires him to carry. “I’m very grateful that I’m in a good position,” he added.

Zablah’s premium increases are a symptom of a broader insurance crisis plaguing real estate markets across America. Experts say it’s fueled, in large part, by the disastrous effects of human-caused climate change.

Flooding is more frequent. Higher temperatures stoke stronger hurricanes. Wildfires burn more acres. And Americans have spent generations moving to sunny places that are often the most in harm’s way, including Florida, Texas, and California.

In Louisiana, some residents along coastal Highway 56 have decided to leave, in part, because they can’t get coverage.

So, the cost of insuring homes against natural disasters is spiking along with atmospheric temperatures and carbon dioxide levels.

Now, new research shows that higher insurance premiums like the one Zablah is paying significantly increase the probability of people falling behind on their mortgages—or motivate them to pay the debt off early. The outcomes spell trouble for banks, and for homeowners.

How significant is the increase in mortgage trouble? A $500 spike in annual insurance premiums was linked to a 20 percent higher mortgage delinquency rate.

That figure was extracted from findings in a recent study, which will be expanded and then undergo peer review, according to Shan Ge, an assistant professor of finance at New York University and one of the paper’s authors.

“What we found, which is the first in the literature, is that as insurance premiums go up, we have seen an increase in delinquency of mortgages,” Ge said. The research adds to a growing body of scientific literature proving that the climate crisis is also a housing crisis.

It’s a crisis with a brutal, but important side effect: Higher premiums may convince people in vulnerable areas like Miami to move out of harm’s way.

“The market is clearly adapting, and there will be winners and losers…but ultimately there should be more winners to the extent that it sends signals and people get out of the way,” said Jesse Keenan, a professor of sustainable real estate and urban planning at Tulane University who was not involved in the study.

Zablah also heads the board of the Brickell Roads condominium association in Miami, where he owns an investment property. The effects of climate change are felt there too.

Brickell Roads residents had been paying $350 a month in condo fees in 2022. But then Weston Insurance, the carrier of the association’s windstorm policy, went bust.

It was the fifth Florida insurance carrier to fold that year in the wake of Hurricane Ian, which slammed into the Southeast United States, causing an estimated $112 billion in damage. It was the most expensive storm ever in Florida and third most expensive in US history.

As the association scrambled to find a replacement policy, it confronted a stark reality: Monthly condo fees would more than triple under their new insurance policy. On October 1, 2023, it raised the condo fee at Brickell Roads to $1,000 a month. (The board has since found another insurance carrier and hopes to lower the fee to $700 a month, according to Zablah.)

“In some Florida counties, homeowners are paying over 5 percent of their income just on their policies.”

Climate change has blown a hole through insurance markets across the United States. In Louisiana, some residents along coastal Highway 56 have decided to leave, in part, because they can’t find companies willing to insure their homes.

In California, that state’s Department of Insurance has barred carriers from not renewing policies in certain fire-prone zip codes, essentially forcing the companies to insure properties there. And in Florida, a volatile mix of fraud, litigation, floods, and hurricanes has left homeowners like those in Brickell Roads scrambling for coverage.

One major reason for the spike in insurance prices is a rise in the cost of the insurance coverage that insurance companies purchase for themselves, known as reinsurance. Globally, reinsurers raised prices for property insurers by 37 percent in 2023. (Prices stabilized somewhat in 2024.)

Insurers have passed those costs on to customers, said industry analyst Cathy Seifert during a Bloomberg TV appearance on November 4. “The insurance industry will leverage climate change into pricing strength,” she said.

Analysts and scholars who study the nexus between climate change and housing had long theorized that higher insurance rates would negatively affect property markets.

An August 2024 report by the Congressional Budget Office noted that in 2023, 30 percent of losses from natural disasters went uninsured. Those losses further constrict an already tight supply of housing. Researchers have also found that higher insurance rates affect the availability of affordable housing. It turns out, housing markets might be more sensitive to premium spikes than many thought.

Using a dataset that links insurance policies with mortgages for 6.7 million borrowers, Ge and two other researchers established that spikes in insurance premiums led a significant number of borrowers to either pay off their mortgages early or fall behind. Obviously, many homeowners can’t afford to accelerate their mortgage payoff.

The researchers found that the effect of premium increases on mortgage delinquency is twice as large for borrowers with a high loan-to-value ratio, meaning they owe a lot of money on their homes compared to the home’s value.

“This is how many people across the country are beginning to directly experience how climate change is changing our world and the cost it’s going to have,” said Moira Birss, a research fellow at the Climate and Community Institute. “In some Florida counties, homeowners are paying over 5 percent of their income just on their (insurance) policies.”

Conversely, the NYU study found that people who took out jumbo mortgages—large loans for expensive houses that regular loans won’t cover—were three times less likely to end up falling behind on payments. Because more than two-thirds of mortgages are backed by the federal government, it’s taxpayers who could be left holding the bag from rising climate-caused delinquencies.

“I think it’s the tip of the iceberg.” said Wayne Pathman, a Miami-based land use attorney who has spent years working on resilience issues in the region. “I think it is going to get a lot worse.”

Pathman says he is seeing similar premium increases in the commercial property insurance market—and is also witnessing owners of office buildings consider choices similar to that of Zablah, the homeowner.

Pathman recounted how one of his clients, a hotel operator, handled a looming increase in his insurance premiums. He paid off the mortgage on the building and decided to forego the $1-million-a-year premiums for windstorms.

So next time a hurricane blows in, he’ll be on his own.