The Audacity of Elon Musk’s $180 Million Pledge to Elect Donald Trump

This story was originally published on Judd Legum’s Substack, Popular Information, to which you can subscribe here.

Billionaire Elon Musk has pledged to give $45 million a month to a Super PAC that’s encouraging swing-state supporters of former President Donald Trump to vote absentee, a practice Musk has publicly described as “insane,” “too risky,” and a recipe for “large-scale fraud.”

Trump has advanced a variety of wild conspiracy theories to falsely claim that he won the 2020 presidential election. One of his favorites is the false claim that supporters of President Joe Biden had stuffed dropboxes with falsified absentee ballots. Right-wing polemicist Dinesh D’Souza created a 90-minute documentary, 2000 Mules, devoted to the baseless allegation about absentee ballots. D’Souza’s documentary was so shoddy that its distributor, Salem Media Group, ultimately pulled the film from the market and issued an apology.

Numerous studies have found that voting by mail is “safe and secure.” A database maintained by the right-wing Heritage Foundation, which supports restrictions on mail-in voting, reported “1,200 cases of vote fraud of all forms” from 2000 to 2020. Of those cases, “204 involved the fraudulent use of absentee ballots.” This amounts to “one case [of fraud using mail-in ballots] per state every six or seven years,” or “about 0.00006 percent of total votes cast.”

Nevertheless, for months, Musk has used X to spread misinformation about absentee ballots to his nearly 190 million followers. Here’s a sampling:

On January 8, Musk wrote that it was “insane” that you can “mail in your ballot” in the United States. The same day, he said the government should require “in-person voting” on a single day, with few exceptions, “like other countries do.”

On February 2, Musk asserted that the Biden campaign was involved in a scheme to submit a massive number of fake absentee ballots.

On February 5, Musk said that absentee ballots are used for widespread fraud because the nature of absentee ballots made “fraud traceability impossible.”

On May 9, Musk falsely claimed that “widespread voting by mail” was “not allowed before the scamdemic” and now “proving fraud [is] almost impossible.”

On July 9, Musk said that we “should mandate paper ballots and in-person voting only” because “anything mailed in is too risky.” In another post the same day, Musk said that “[m]ail-in and drop box ballots should not be allowed” because they facilitate “large-scale fraud.”

Musk’s X account has become the social media equivalent of 2000 Mules, grasping to justify Trump’s lies about the last presidential election. Musk’s diatribes against absentee voting have occurred as Trump and Musk are reportedly “developing a friendly rapport and talk on the phone several times a month as the election nears.”

A recent FEC decision means that America PAC, which is focusing on canvassing to increase absentee voting in swing states, can coordinate directly with the Trump campaign.

As a result, it’s not entirely surprising that, on Tuesday, Bloomberg reported that Musk would be donating $45 million a month to a Super PAC supporting Trump’s campaign. (Musk previously pledged not to donate to Trump or Biden.) The contributions to America PAC, which was formed in May, would make Musk the biggest financial backer of Trump in 2024 and one of the largest political donors of all time.

How will America PAC spend Musk’s money? According to the Wall Street Journal, it will focus on “persuading constituents to vote early and request mail-in ballots in swing states.” Already, America PAC has hired hundreds of workers who are “having conversations with constituents in swing states and urging voters to request mail-in ballots.”

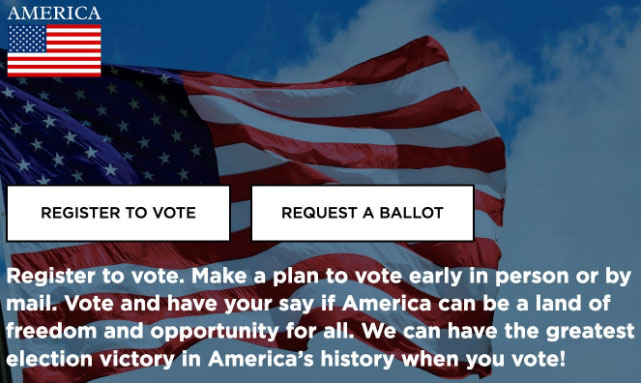

The America PAC website encourages Trump supporters to “vote early in person or by mail.” It includes a link for voters to request an absentee ballot. So, on the one hand, Musk is telling millions of people that absentee ballots are “insane” and a vehicle for “large-scale fraud.” On the other hand, he may spend up to $180 million, by some estimates, to encourage more Trump supporters to vote absentee.

Musk’s large donations to America PAC will position it to aggressively exploit a new loophole in federal campaign finance law. A Super PAC can raise and spend unlimited amounts of money to support (or oppose) a federal candidate. But, as a general rule, it cannot coordinate directly with a candidate’s campaign. Earlier this year, however, the Federal Election Commission (FEC) created a significant exception.

In a March 20 advisory opinion, the FEC decided that “canvassing literature and scripts are not public communications, and as a result are not coordinated communications under Commission regulations.” That means that America PAC, which is focusing on canvassing to increase absentee voting in swing states, can coordinate its messaging directly with the Trump campaign.

The FEC made this determination based on the idea that canvassing is “a traditional grassroots activity fundamentally different” from mass mailings or television advertisements. Now this loophole will allow the Trump campaign to effectively control messaging backed by hundreds of millions of donations from Musk and a few other very wealthy people.

The FEC is composed of three Republican and three Democratic commissioners. For years, that has deadlocked the FEC, preventing it from issuing any significant rules or opinions. That has changed in recent months as Commissioner Dara Lindenbaum, a Democrat appointed by President Biden in 2022, has repeatedly sided with the three Republican commissioners to weaken campaign finance regulations.